A pyramid scheme is an unsustainable business model that involves promising participants payment or services, primarily for enrolling other people into the scheme, rather than supplying any real investment or sale of products or services to the public. Pyramid schemes are illegal because they inevitably collapse when recruiting new members becomes impossible and most members lose money.

How Pyramid Schemes Work

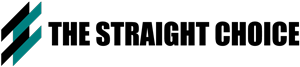

A pyramid scheme typically works as follows:

- A person (the initial recruiter) recruits a certain number of people and takes an upfront payment from each recruit. This recruit is now at the bottom level of the pyramid.

- The new recruits are encouraged or required to recruit more members and collect payments from them. A portion of these payments gets passed up the pyramid to the people above them.

- As each new level of recruits enters the pyramid, the people at the top earn money from a share of the payments of all those below them in the pyramid.

- Eventually, recruitment of new members dries up and the pyramid collapses, with most people losing the money they paid to join.

In pyramid schemes, participants primarily earn money by recruiting new members rather than by selling goods or services to the public. The money comes from inside the pyramid structure, not from any real investments or sales from outside. It’s essential to be cautious and thoroughly research any opportunity that involves recruitment-based earnings. One should scrutinize the business model and ask questions to ensure legitimacy. Discover that is blue raven solar a pyramid scheme and it requires careful investigation into its practices and financial structure.

Key Characteristics of Pyramid Schemes

Here are some key characteristics that help identify a pyramid scheme:

- Emphasis on recruitment – The bulk of any income comes from recruiting new members rather than legitimate product sales.

- Upfront entry costs – There is typically an upfront cost to join, either an investment or mandatory purchases of products or services. This entry cost mainly profits those at the top.

- Complex commission structure – The compensation plan often involves complex commissions tied to recruitment of new members. The goal is to disguise the fact that payment is mainly for recruitment rather than product sales.

- Selling a dream – Recruits are sold on dubious promises of high returns, lavish lifestyles, and exotic vacations, rather than solid business fundamentals.

- No genuine product or service – Pyramid schemes tend to lack any real product or service that can generate revenue independently of the money taken from new recruits.

- Downplaying or hiding the pyramid structure – Pyramid schemes often attempt to portray the business as a legitimate multi-level marketing program, rather than revealing the true pyramid-shaped compensation structure.

Why Pyramid Schemes Are Illegal

Pyramid schemes are declared illegal in most countries because they are exploitative and destined to collapse. Here are some of the key reasons why pyramid schemes are illegal:

1. Pyramid structure is inherently unstable

The pyramid structure itself is mathematically unsustainable. As each level recruits more members, the number of potential recruits keeps dwindling. When the market saturates and recruitment slows down, there is not enough money coming in at the bottom levels to keep paying those at the top. So the pyramid collapses and most people lose their money.

2. No legitimate products or services

Pyramid schemes make most of their revenue from entry fees and recruitment, rather than real retail sales to customers outside the organization. Without real products or services, the scheme cannot generate sufficient external revenue to stay afloat.

3. Revenue relies on endless chain of recruitment

For a pyramid scheme to keep going, it requires an endless chain of new recruits. This exponential progression is impossible to sustain indefinitely, since the pool of potential recruits is finite.

4. Majority of participants inevitably lose money

Due to the flawed exponential model, those who join the pyramid late typically lose their money. Studies show 80-90% of pyramid scheme participants end up with a net loss. This contrasts with a legitimate multi-level marketing program where commission is tied to product sales.

5. Deception and cult-like techniques used to lure recruits

Pyramid schemes often use deception, pressure tactics, and cult-like techniques to get new recruits and keep them motivated. False promises of high earnings are used to convince people to join and stay committed.

6. Rewards for recruitment over product sales

When commissions are paid based on recruiting others rather than actual product sales, it indicates the business is more focused on transferring funds internally rather than generating revenue externally. This is a telltale sign of a pyramid scheme.

7. High entry costs

Pyramid schemes tend to require high upfront entry costs in the form of training or inventory purchases to maximize profits for those at the top. Legitimate programs have much lower entry costs and do not base rewards primarily on recruitment.

Major Pyramid Schemes in History

Here are some of the biggest pyramid schemes that made headlines over the years:

Bernard Madoff Investment Securities LLC

This infamous Ponzi scheme run by Bernard Madoff defrauded thousands of investors out of an estimated $64.8 billion over several decades, the largest financial fraud in U.S. history.

Herbalife

Herbalife has long been subject to investigation over its alleged use of a pyramid structure. The company has paid hundreds of millions in settlements over false income claims but denies being a pyramid scheme.

AdSurfDaily

This internet advertising company was shut down by the U.S. government and its owner charged with operating a Ponzi scheme that took in over $100 million.

WorldVentures

This multi-level marketing travel company has been accused of being a pyramid scheme in several countries. Norway’s Supreme Court ruled WorldVentures was an illegal pyramid scheme in 2022.

Enron Corporation

Enron executives employed accounting fraud and earned millions while investors and employees lost billions when the company went bankrupt in 2001.

Fyre Festival

This infamous failed music festival scammed attendees out of millions of dollars through false promises while organizers enriched themselves. The organizer was convicted of fraud.

NXIVM

This organization offered personal development seminars but was accused of being a pyramid scheme-linked sex cult. Several leaders were convicted of racketeering and sex trafficking.

OneCoin

This massive global Ponzi scheme took in billions by selling fake cryptocurrency to unsuspecting investors before regulators cracked down on it.

TelexFree

Claiming to be an internet phone service, this Brazilian company took in billions worldwide through an illegal pyramid scheme before its top executives were indicted in the U.S.

Laws and Regulations Against Pyramid Schemes

Most countries have laws banning pyramid scheme practices to protect consumers from exploitation:

- U.S. – Pyramid schemes violate Section 5 of the Federal Trade Commission Act prohibiting unfair and deceptive business practices. They also violate state anti-pyramid scheme statutes.

- Canada – Pyramid schemes violate Section 55 of the Competition Act as criminal offenses of deceptive marketing.

- UK – The Financial Services and Markets Act 2000 prohibits promotion of collective investment schemes like pyramid schemes.

- Australia – Pyramid schemes are banned under the Australian Consumer Law as misleading and deceptive conduct.

- South Africa – The Consumer Protection Act of 2008 prohibits multi-level marketing and pyramid schemes.

In addition, many countries regulate multi-level marketing companies to prevent pyramid scheme-like practices:

- Limiting commission earned from recruiting new members versus product sales

- Requiring buyback policies for unsold inventory

- Capping monthly purchases of products

- Requiring easily attainable sales targets

- Providing cooling-off periods to obtain refunds

Legitimate Direct Selling vs. Pyramid Schemes

While pyramid schemes are illegal, legitimate direct selling involves selling real products or services directly to customers through independent sales representatives. Here are some ways direct sales differ from pyramid schemes:

- Product focus – Direct selling focuses on product demonstrations and sales to generate income rather than recruitment.

- Manageable startup costs – Joining fees are generally low in direct selling. Companies rarely require large inventory purchases.

- Realistic incentives – Compensation is largely based on your own sales volume, rather than rewards for expanding “downlines.”

- No recruitment commissions – Commissions are tied to product sales, not recruitment of other representatives.

- Buyback policy – Legitimate companies have buyback policies for unused inventory. Pyramid schemes typically do not.

- Voluntary purchases – Representatives are not pressured to buy more than they can sell or use. Pyramid schemes push inventory loading.

So while direct selling and pyramid schemes may seem similar on the surface, there are important distinctions in terms of sales versus recruitment focus, manageable costs, and sustainable commission structures.

Warning Signs of a Pyramid Scheme

Here are some red flags to watch out for if you suspect a business opportunity may be an illegal pyramid scheme:

- You have to pay a large upfront entry fee or purchase expensive inventory.

- The focus is on recruiting new distributors rather than selling products to real customers.

- The marketing emphasizes getting rich quick through passive income.

- Commission is based on adding recruits to your downline rather than your own sales.

- You are encouraged to buy more products than you could realistically sell or use.

- Promises of high returns seem unrealistic for the business model.

- Products are vague, overpriced, or seem bogus.

- The business uses cult-like techniques to motivate distributors.

- You have to recruit new members to fully participate and earn promised rewards.

- The company is vague about their structure, products, or actual revenues.

Protecting Yourself from Pyramid Schemes

Here are some tips to avoid losing money in an illegal pyramid scheme:

- Research the company extensively online looking for complaints, investigations, or legal issues.

- Beware “too good to be true” earnings claims. Consult income disclosure statements if available.

- Ask for detailed information on the product or service, its pricing, and the compensation plan.

- Don’t pay high upfront costs like large enrollment fees or mandatory inventory purchases.

- Make sure sales commissions are tied to your own product sales, not recruitment.

- Understand the market size for reselling a product before investing in inventory.

- Review company policies on inventory buybacks, returns, and refunds.

- Walk away from high-pressure recruiting tactics. Never let someone coerce you into spending money.

- Contact regulators if you suspect a scheme. Report fraud or misleading claims.

Consequences of Running or Promoting Pyramid Schemes

Here are some potential consequences for those who operate or promote illegal pyramid schemes:

- Fines – The Federal Trade Commission and other regulators impose large fines on pyramid schemes violating consumer protection laws. Fines can be tens of millions of dollars.

- Asset seizure – Regulators may seize assets like real estate, bank accounts, and luxury items obtained with funds from an illegal scheme.

- Criminal charges – Pyramid scheme operators often face criminal fraud, conspiracy, and racketeering charges, which can lead to prison time.

- Lawsuits – Victims file class action lawsuits to recover losses, costing scheme operators large settlements and legal fees.

- Ban from industry – Regulators ban pyramid scheme promoters from ever operating or working in similar industries again.

- Restitution payments – Those convicted of pyramid schemes may be ordered to repay all victims’ losses as part of a sentence.

- Reputational damage – Promoters of pyramid schemes experience lasting reputational damage and public scorn that derails other business ventures and careers.

- Financial ruin – Pyramid schemes ultimately collapse, leaving operators financially ruined with massive debts and legal liabilities.

In Summary

Pyramid schemes are fraudulent business models in which members earn money primarily for enrolling other people rather than selling real products or services. These exploitative schemes inevitably collapse when recruitment slows, leaving most participants with financial losses. Pyramid schemes are illegal in most countries due to their deceptive nature, lack of real products or services, and reliance on endless chains of recruitment. Understanding what you need to know about HSA contributions is crucial for making informed financial decisions; just as with an awareness of the factors that make pyramid schemes unsustainable and illegal, consumers can make smart choices and safely take advantage of real income opportunities.

Frequently Asked Questions

What is the main difference between legitimate MLM and a pyramid scheme?

The main difference is that MLMs focus on selling products to generate income, while pyramid schemes focus on expanding a network of recruits. MLMs earn money from product sales, not recruitment.

How can you spot a pyramid scheme disguised as a legitimate MLM?

Red flags of a pyramid scheme masquerading as MLM include emphasis on recruitment, requirеd inventory loading, lack of a real product, and rewards tied to expanding your downline, not sales.

Are pyramid schemes completely illegal or just mostly illegal?

Pyramid schemes are completely illegal in the U.S. and most countries. They directly violate anti-pyramid scheme statutes and consumer protection laws against unfair and deceptive practices.

Can you unwittingly become part of a pyramid scheme?

Yes, it’s possible to become entangled in a pyramid scheme without realizing it at first. They often downplay recruitment and may not reveal the full business model upfront. Do your research before joining any opportunity.

What should you do if you realize you have become involved in a pyramid scheme?

If you realize you’re in a pyramid scheme, stop participating immediately. Report it to regulators, consult an attorney about recovering any losses, and warn friends and family about it if you recruited any.